About Us

The Easiest Way to Manage Your Personal Finances

Ramrajya Sahakari Bank Ltd. is a cooperative bank based in Pune, Maharashtra, India. Established in the year 1997, the bank operates with the primary objective of providing banking and financial services to its members and customers. It is registered under the Cooperative Societies Act and functions as a cooperative society.

The bank offers a wide range of banking products and services to cater to the financial needs of its customers. These services include savings and current accounts, fixed deposits, recurring deposits, loans, money transfers, online banking, and other allied services. Ramrajya Sahakari Bank aims to provide convenient and efficient banking solutions to its customers while upholding the cooperative values of trust and integrity.

Ramrajya Sahakari Bank is committed to contributing to the socio-economic development of the community it serves. It actively participates in various community welfare activities and initiatives, supporting education, healthcare, and other social causes.

Our Vision

"To empower communities through sustainable financial solutions, fostering inclusive growth, and cultivating trust, while prioritizing customer satisfaction, social responsibility, and technological innovation."

Our Mission

"Our mission is to serve our members by providing accessible and transparent banking services, promoting financial literacy, supporting local businesses, and contributing to the economic well-being of our community."

Our Smart Banking Services

- All Branches including Head Office connected through CBS.

- Instant Gold available across all branches.

- RTGS/NEFT facility available in all branches.

- Quick loan available as per requirement.

- ATM withdrawal facility available with RuPay Cards.

- Locker facility available at Bibwewadi, Nanded, Nasrapur, Wagholi & Ravet branches.

- Banking Services provided eight hours daily.

Meet The People Behind The Mission

Constantly innovating & ensuring to follow the state-of-art in banking, with highest ethical standards and integrity.

Ramrajya Cooperative Bank was founded by Mr.Vijayrao Ganpatrao Mohite in the year 1997. Shri.Vijayrao Ganapatrao Mohite and his colleagues came together to establish a cooperative society for the common people to help poor people with money, First time share collection because there were many difficulties but with the efforts of all the co-operatives the Ram Rajya Co-operative Bank was established. Heartfelt thanks to all our shareholders, depositors, borrowers and well-wishers whose meaningful, strong and selfless support has enabled the Bank to make such progress.

In the progress of the bank since its establishment till date, with the cooperation of all of you, all the directors have successfully expanded the bank to 7 branches and also the proposed Rawet branch is going on and even today the bank is providing banking service facility to the account holders at a very low rate and for that Hon. The Board of Directors has taken into consideration the need for computerization of transactions and since then has started computerization of the entire operations of the bank.

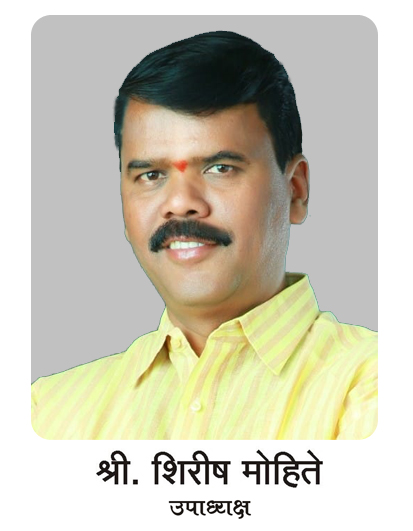

First of all we thank you all for conducting the election of the Board of Directors of the Bank unopposed. Also, I express my gratitude to all the members and the board of directors for showing your trust in us by electing me as the president of the bank and my colleague Mr. Shirish Mohite as the vice president of the bank without opposition. Of course, this has motivated me and all my colleagues to work more vigorously for the betterment and welfare of the organization. The policy of free economy adopted by our country, the environment of global recession is affecting the Indian economy. Due to this, the Reserve Bank of India is planning various measures to reduce the combined effect of rising inflation, fiscal deficit, rising price of mineral oil, unemployment. It affects the banking business. Competitive interest rates on deposits and loans as per Reserve Bank of India regulations have made it challenging to lend to members and account holders and similarly provide various banking services to maximum number of members and account holders. Even in all these circumstances, the bank has kept interest rates on deposits and loans attractive.

As the Vice President of a cooperative bank, I see our institution as a beacon of trust, stability, and community empowerment. Our bank stands tall, exuding an air of professionalism and integrity. The polished marble floors lead customers to the heart of our operation, where dedicated staff members warmly greet them with genuine smiles. Behind the scenes, our cutting-edge technology ensures seamless transactions and secure financial services. We pride ourselves on our personalized approach, understanding the unique needs of our members and offering tailored solutions. Together, we foster a culture of cooperation, mutual support, and financial well-being, making our bank a trusted partner in the journey of prosperity. As the Vice President of a cooperative bank, I am privileged to witness the inner workings of our institution through a lens of pride and dedication. Our bank is not just a financial institution; it is a hub of trust, collaboration, and community empowerment.

Let’s work together in the process of development so that it is easy to take the bank forward. We always expect your guidance.

Board of Management

The Board of Management in Ramrajya Sahakari Bank is a group of senior executives responsible for guiding the bank’s operations and ensuring strategic objectives are met. They make key decisions, manage risks, and ensure compliance. The board sets the bank’s strategic direction, oversees financial performance, and establishes effective governance practices. It manages relationships with stakeholders, including shareholders, customers, employees, and regulators. The board plays a critical role in shaping the bank’s success by providing leadership, expertise, and accountability in the dynamic and highly regulated banking industry.

The Board of Management holds significant responsibilities in guiding and overseeing the bank’s activities. Some of the key responsibilities include:

- Strategic Decision-Making.

- Risk Management.

- Financial Performance.

- Compliance and Governance.

- Stakeholder Management.